Bullish Crude Oil, Likely To Reverse?

The WTI Crude Oil continues to trade bullish at $53.60, maintaining a bullish momentum for the 5th consecutive trading day. Most of the bullish fluctuations in the oil are being caused by the ongoing tensions between the U.S and Syria.

Investors are concerned about the US missile strike in Syria. This action boosts the odds for conflict with Syrian allies Russia and Iran. Syria influences oil prices due to its oil reserves. Though Syria does not have the largest oil supply it has a large enough supply that its state affects oil prices.

Most importantly, we have crude oil inventories due today at 15:30 (GMT). Economists are expecting a drop in the inventory build by -0.7M barrels. One thing is clear, if we don't see a drop in the inventories, then our crude oil trade will be at risk.

WTI Crude Oil – Hourly Chart

WTI Crude Oil – Hourly Chart

Technical Outlook

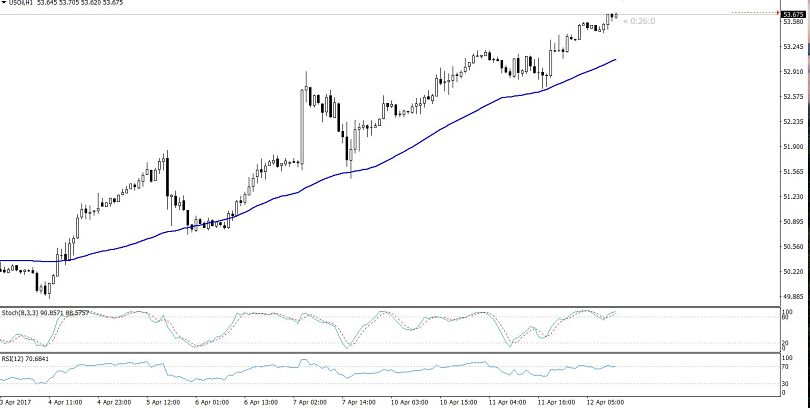

Looking at the charts, the crude oil is trading at the top edge of its bullish trend and it's also trading in the overbought territory in the RSI. But this is the nature of crude oil – it remains in the overbought territory and continues to trade higher.

We have often discussed that crude oil is more concerned about its supply and demand rather than technicals. However, we can see in the 4 – hour chart that the oil is trading above 50- periods EMA. The upward channel in the 4 – hour timeframe suggest a major resistance at $53.90 along with an intra-day support at $53.14.

Forex Trading Signal

We have opened a buying position above $53.60 along with a stop loss of $53.35 and a take profit of $53.85. Traders, we need to monitor the crude oil inventory figures as any surprise has potential to cause volatility in the market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM